Portfolio Building Blocks

There are no perfect investments, but there are near-perfect portfolios.

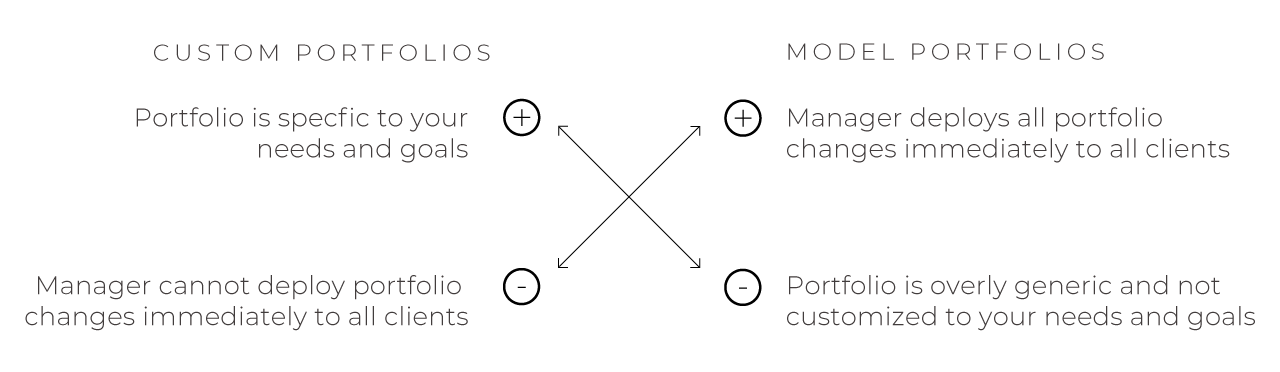

Many investment managers create custom portfolios for each client, while others assign clients to one of several “model portfolios.” The reality is that each of these avenues has benefits and shortcomings, making them imperfect.

Our Quadrant Plan approach seeks to integrate the benefits of both custom portfolios and model portfolios. We offer a variety of investment strategies, which we consider building blocks for your portfolio. Our investment strategies intentionally complement one another by maintaining a unique focus and targeted investment exposure. The Quadrant Plan framework allows us to uniquely tailor a mix of portfolios to your specific situation.

The whole is greater than the sum of its parts.

Benefits of the Quadrant Plan

Many investors believe that diversification across securities and financial markets adds value to their portfolio. We believe this concept should be taken a step further by diversifying your portfolio across different types of investment management approaches, or objectives. The Quadrant Plan allocates your portfolio’s underlying accounts into various quadrants, which provides you with much more control and flexibility in several key areas:

TAX MANAGEMENT

Our goal is to optimize your tax situation by deliberately locating the strategies used across your quadrants based on the tax efficiency of your account types.

DIVERSIFICATION

Not only is your portfolio diversified across individual securities (stocks, bonds, funds, etc.) and asset classes (US stocks, foreign investments, bonds, etc.), but also by portfolio objective represented by each quadrant.

TIME HORIZON

Each quadrant, or “bucket” can have varying time horizons giving more specificity around planning for future withdrawal needs and thereby striving to improve your portfolio longevity.

WITHDRAWAL STRATEGY

Portfolio withdrawals can be strategically directed from specific quadrants, minimizing the need to sell out of higher risk assets during market declines.

ILLIQUID ASSETS

Your portfolio quadrants can be easily adjusted to compliment non-publicly traded holdings, illiquid investments, or other financial assets so that your overall portfolio matches your goals and risk.

PERSONAL PREFERENCES

The investment strategies used across your quadrants are impacted by your specific priorities and preferences allowing for powerful customization.

Portfolios with Purpose

The Quadrant Plan helps you identify your investment needs and, as a result, ensure your portfolio has an appropriate emphasis across four purposes.

Liquid

Purpose – Income Yield, Accessibility

Investments – Money Markets, Bonds, Cash

Balanced

Purpose – Foundational Diversification, Total Return, Growth & Income

Investments – Broad Market Exposure Including Stocks, Bonds, Alternative Assests

Protected

Purpose – Preservation, Stability

Investments – CDs, Annuities, Structured Products

Growth

Purpose – Capital Appreciation, Outpace Inflation

Investments – Stocks, Uncorrelated Assets, Growth-Oriented Investment Strategies

Investment advisory and financial planning services offered through Simplicity Wealth, LLC, a SEC Registered Investment Advisor. Subadvisory services are provided by Simplicity Solutions, LLC, a SEC Registered Investment Advisor. Insurance, Consulting and Education services offered through Ward & Associates Financial Group. Ward & Associates Financial Group is a separate and unaffiliated entity from Simplicity Wealth, LLC and Simplicity Solutions, LLC.